PHARMACY 4.0

THE IMPORTANCE OF POLPHARMA IN BUILDING AN INNOVATIVE ECONOMY

Polpharma is a leader of the Polish pharmaceutical industry, a major investor, an innovator and a major company among the top twenty generic manufacturers in the world.

In this report we analyze what is the reason for its undoubted success and how it translates into the development of the Polish economy. We also point out the most important challenges facing Polpharma and the Polish pharmaceutical sector.

Share

POLPHARMA IN FIGURES

MORE THAN 7,000 EMPLOYEES WORLDWIDE

PRESENT IN 60 GLOBAL MARKETS

THE 20TH LARGEST GENERIC COMPANY IN THE WORLD

64 ACTIVE PATENTS

OVER 600 MOLECULES IN PORTFOLIO

41 DRUGS WITHOUT AN EQUIVALENT

INVESTMENTS IN THE DEVELOPMENT OF BIOLOGIC DRUG PRODUCTION AND MANUFACTURING TECHNOLOGIES

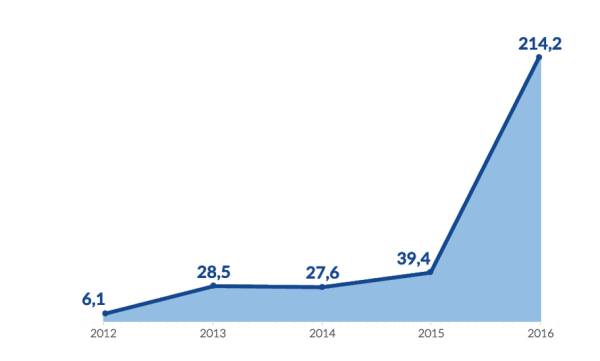

Investments in biotechnologies are nowadays considered to be one of the most promising directions of development in the pharmaceutical sector:

- since 2012, Polpharma Group’s spending on its biotech division has been growing steadily,

- Polpharma plans to become the only producer and manufacturer of biological drugs in Poland by investing in a production plant in Duchnice (planned start-up in 2019, investment value PLN 451.5 million) and a state-of-the-art laboratory in Gdansk (investment value PLN 224.7 million)

- The Group took over the innovative Dutch biotechnology company Bioceros, thus emphasizing its role in the still too small group of Polish companies investing abroad

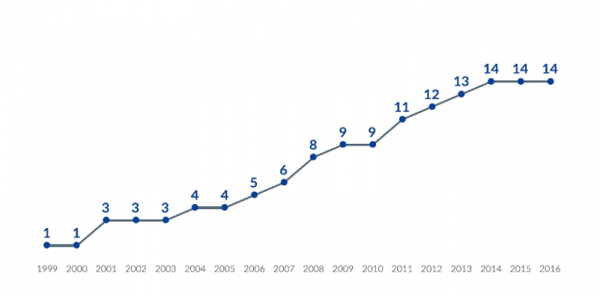

DEVELOPMENT OF AN EXTENSIVE PATENT PORTFOLIO

Polpharma’s patent portfolio development includes:

- substances(Polpharma has developed new methods of obtaining a number of therapeutic active substances)

- drug forms (in the case of many widely used drugs, Polpharma managed to change the form of administration or eliminate harmful preservatives, thus improving the quality of patient treatment)

- biotechnological innovations (despite only a few years of involvement in the development of Polpharma’s biotechnology division, the company has managed to obtain several patents for both the development of new cell lines and new agents used in the production of biological substances)

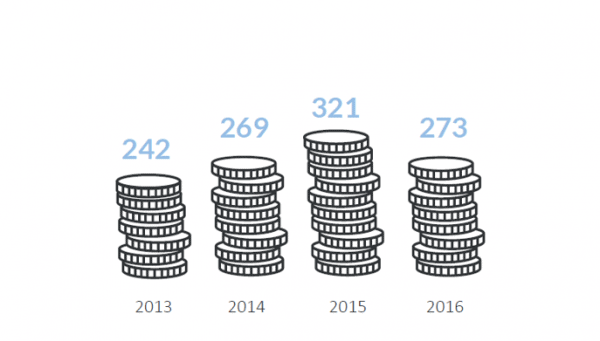

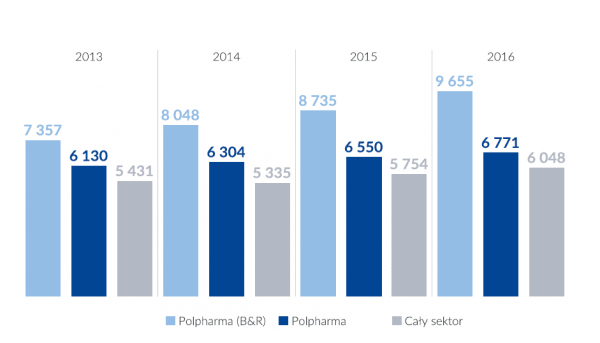

Polpharma is not an occasional innovator. Successively growing expenditure on R&D (between 2012 and 2015 it accounted for more than 50% of the total pharmaceuticals sector expenditure in Poland for this purpose) is systematically translated into new patent applications.

CHANGES GUIDING POLPHARMA TOWARDS PHARMA 4.0.

- Polpharma is one of the few Polish companies to implement new technologies on a large scale, which makes it a pioneer in the field of so-called Industry 4.0, i.e. a new way of organising production and company operations resulting from broad integration of a variety of computer-controlled processes

- Integration and further automation of organizational and production processes in Polpharma includes management of buildings, production, human resources, logistics, document flow, data visualization and processing as well as communication with subcontractors

CURRENT IMPLEMENTATIONS OF INDUSTRY 4.0 USED IN POLPHARMA GROUP

STRATEGIC INVESTMENTS IN HUMAN CAPITAL

- Polpharma Group accounts for 16% of all employees in the Polish pharmaceutical industry,

- Salaries here are on average 12% higher than those of competitors,

- The proportion of R&D staff in the Polpharma Group clearly exceeds that of the Polish pharmaceutical industry and their salaries are on average 50% higher than those of the competition,

- Polpharma actively counteracts the outflow of highly qualified workforce by conducting return programmes for Polish biotechnologists and chemists employed by Western European companies

- It also promotes the return of abandoned cooperation with educational institutions by co-running dual classes at the technical school level and biomedical faculties at the university level

Every 7th employee in the pharmaceutical sector is employed by Polpharma Group.

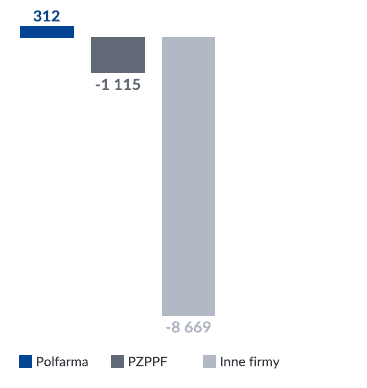

CONSISTENT FOREIGN EXPANSION

- Polpharma Group has a positive foreign trade balance and the value of exports exceeds the value of imports, which gives the company an exceptional status compared to other pharmaceutical companies

- Polpharma adopts direct investment strategies in high-potential markets such as Russia and Kazakhstan, where it supports acquisitions and mergers with local partners and has its own drug production facilities From these countries it exports drugs to traditionally trade-linked neighbouring countries

- In smaller developing markets Polpharma adopts a sales development strategy based on its own sales offices or local distributors of drugs exported from Poland. It is present in all global markets, in a total of 60 countries – either as a drug manufacturer, active ingredient supplier or a company that licenses its products

Over 90% of Polpharma’s exports are compounded and unblended drugs.

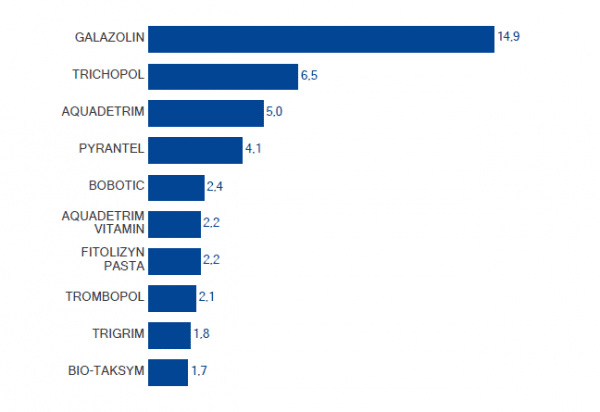

IMPACT ON THE COUNTRY’S DRUG SECURITY

- Polpharma as a domestic manufacturer of drugs and active substances provides access to treatment for a wide range of patients in case of unexpected events (public health crises, economic downturn, etc.).

- Thanks to generic production, the prices of drugs previously covered by protection (so-called original drugs) are reduced by 80%, which allows for a significant broadening of the group of patients covered by therapy

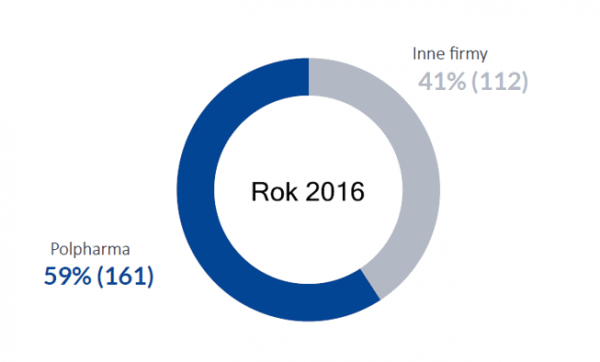

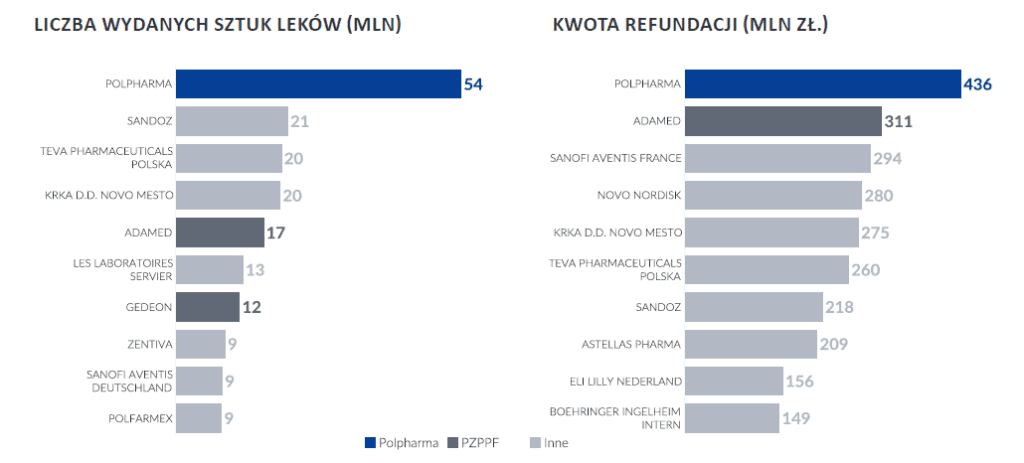

SUPPLY OF REIMBURSED DRUGS IN 2016. (TOP 10 COMPANIES)

Source: NFZ.

From the perspective of the country’s drug security, it is incomparably more important to support access to cheap and effective drugs for hypertension, which affects one in four Poles, than to stimulate investment in the development of new treatments for rare diseases.

Authors of the report

dr. Jacek Lewkowicz